Introduction

Accelerating the energy transition to a low-carbon footprint system is often brought up as a key component of post-Covid-19 recovery planning, Re-industrialization and relocation of industrial activity are also themes that are part of this discussion.

Where will industrial stakeholders position themselves on these issues ? To answer this question, three aspects need to be included into consideration:

- The differences between industrial sectors in the face of carbon pricing ;

- The balance between a market-based strategy and a strategy based on the price of carbon ;

- The balance between the objective of minimizing the carbon footprint and other factors that determine the development of industrial systems.

1. The divergence between industrial sectors on carbon pricing

The most commonly considered strategy for reducing the carbon footprint is to anticipate a rising carbon price and to invest in new technological infrastructures that are carbon-free or reduce the carbon footprint. Anticipating such an increase is reasonable as the carbon market is nothing more than an instrument put in place by public authorities to drive the decarbonization of a complex economic system.

Within this system, industrial companies fall into two categories: companies for whom carbon pricing is strictly a cost of doing business, and companies for whom carbon pricing constitutes a business opportunity. Indeed, some industrial sectors are positioning themselves to reduce their carbon footprint, as well develop the business of reducing the footprint of other players. Some, but certainly not all. Anticipation is difficult, which in turn encourages wait-and-see attitudes. A lot of projects attempt to reconcile existing carbon-emitting activities with the requirements of carbon neutrality as much as possible. Extracting oil by injecting captured carbon dioxide is an example of this type of approach.

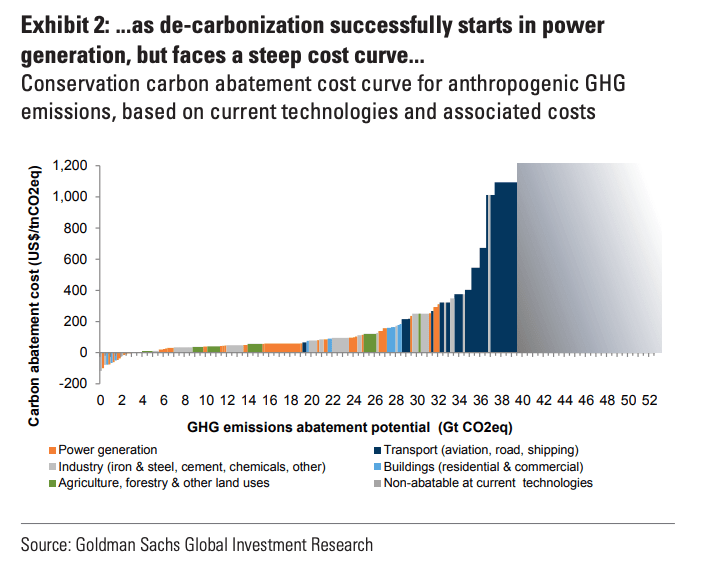

How then do different industrial sectors position themselves with regard to the objective of carbon neutrality? The following graph can help to clarify this:

This de-carbonization cost curve graph, taken from a Goldman Sachs report dated December 2019, shows a relationship between the decarbonization of an industry sector, and the price of carbon. Most heavy industry transformations take place at a price below $200. This graph confirms that the pace of decarbonization is viewed quite differently across industries. Concretely, energy companies are able to make money at a low carbon price, whereas other activities, especially transportation, would lose on their decarbonization investments as long as the price does not rise above $200, or even $1000 for air or maritime transportation.

2. Carbon price-based strategy or market price-based strategy?

Another industrial strategy to reduce the carbon footprint exists, based on the current prices determined by the existing markets for industrial products. The idea is to develop low-carbon technologies that are disruptive to carbon-emitting technologies. We have already mentioned this type of approach in a previous article. It is a more straightforward approach to decarbonization, but it is also a strategy that is limited by the economic competitiveness of existing carbon heavy products. But some, typically off-the-radar, green technologies are now close to the level of maturity that would allow them to directly disrupt certain markets, such as the petrochemical sector.

This type of strategy is highly conditional on technological factors and is simply not available certain sectors. More specifically, the automotive industry faces a situation in which strategic choices are particularly difficult. On the one hand, this sector is uncertain about its ability to produce profitable electric vehicles, which represent a complex challenge involving technology, usage scenarios, and business models. On the other hand, the sector is exposed to very heavy fines if it exceeds its greenhouse gas emission quotas. On top of this, the severe post-COVID19 economic crisis further reduces the reserves and ability to invest of this sector.

3. The balance between decarbonization and industrial development

Current policy subordinates industrial development to the market process (the raison d’être of industrial activity is profit), and the market process to environmental constraints (leading in effect to the prohibition of certain technologies). This logic has two very topical consequences:

- On the one hand, the Covid-19 health crisis has revealed or reminded us of the importance for a country to have local industrial capacities. Basing industrial policy on a market logic can lead to compromising a country’s industrial resilience. The market is not a good substitute for industrial policy.

- On the other hand, any environmental policy is in fact also an implicit industrial policy. But, as we have seen in the case of the automotive sector, the ability to prohibit one technology does not necessarily go hand in hand with the ability to decree the profitability of another technology.

Many actual or potential conflicts arise from this configuration. How can these conflicts manifest themselves? We have a recent illustration of this: in November 2018, the Yellow Vests blocked economic activities in France to prevent what amounts to a rise in the price of carbon for car users. Generally speaking, blockades are the price of systemic divergences that we all end up paying for. Industrial development is based on the opposite of this: systemic convergences.

Conclusion

We have seen that not all industrial sectors are on an equal footing when it comes to reducing their carbon footprint. Reducing one’s carbon footprint in a post-COVID19 world, therefore, involves reducing systemic divergences and identifying as many convergences as possible. What are we doing to contribute to this goal?

Better understanding the potential for convergence based on the needs of industrial stakeholders, better understanding the context in which the industrial players operate, all this is part of Presans’ mission, notably through our Synergy Factory service. More recently, we have also launched the We Are Resilient webinar series with the same goal in mind: to pool our experiences in order to increase the industrial resilience of the system in which we live.