What would a company look like where each contributor share of the company goes up or down in real time, as a function of his contributions? I often ask myself this question.

Cost of contracting typically leads to restricting equity-based compensation packages to top management. But what if it were possible to update the ownership structure at a much lower cost? How would greater access to equity transform the work culture within organizations and their extended ecosystems?

Quidli’s core belief is that access to equity is part of the future of work

Quidli is a startup founded on the premise that one of the key features of the future of work will be far broader access to compensation packages that combine equity and salary.

The talent on demand industry stands to be revolutionized by such a broadening of access to equity. This industry can be broken down into three segments: interchangeable and low-skilled talent, highly-skilled standardized talent, and non-standardized highly-skilled talent. The second and third segments have the most to gain from broader access to equity.

Technological talent platforms such as Presans are certainly starting to take notice of the game-changer potential contained within the Quidli solution. Let’s break down why.

1. The Quidli story

The origin story of Quidli has a lot to do with Skylight, the previous startup of Quidli co-founder Florent Bolzinger. The entirety of Skylight’s staff received variable amounts of equity in addition to their cash compensations, reducing the gap between employer and employees and ensuring a high level of motivation and commitment within the team.

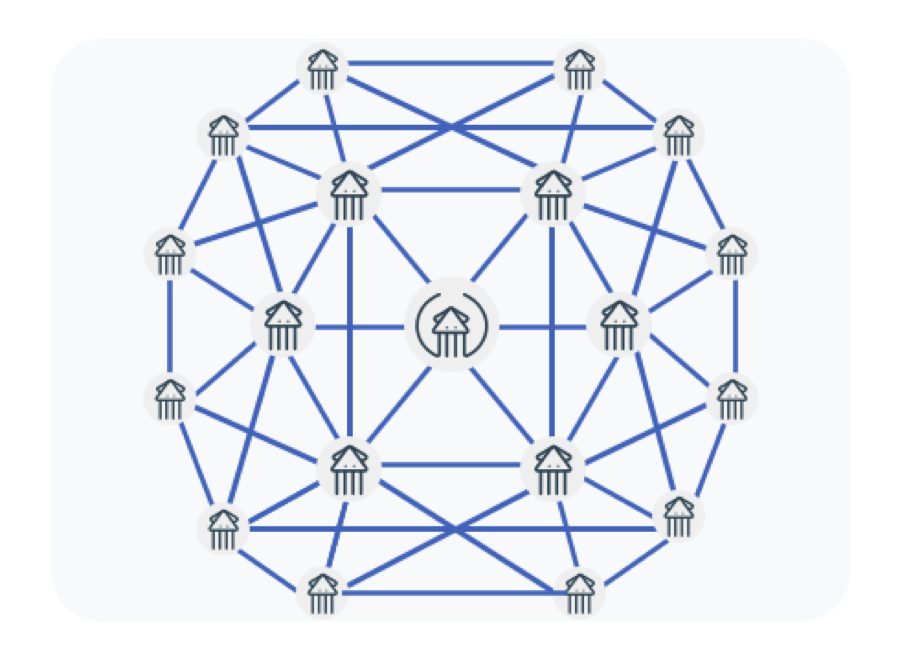

A relevant application of Blockchain technology

Why not generalize this approach? Recent changes in French and US legislation now make it possible to use blockchain to record a company ownership structure in a distributed ledger. What makes blockchain technology relevant in this context is that it allows to integrate and automatize any equity transfer rules or restrictions, enabling to update the ledger with a minimal involvement of lawyers and accountants, and to reduce the cost and time spent on the process.

2. Flexible compensation packages

Current equity compensation for top management takes the form of equity vesting. Equity vesting can help to create long-term incentives, however, it only represents one way among many other possibilities of integrating equity into a compensation package.

Quidli proposes a solution for distributing equity based on other considerations. It can, for example, be useful to distribute equity in variable monthly increments. It can also be useful to tie equity to performance metrics.

Equity has both advantages and limitations

The idea of equity-based compensation has its limits. Equity does not replace a salaried fixed income, but it complements it. In most cases, contributors will require a cash compensation that carries minimal risk. Additional equity rewards provide a welcome exposure to the upside of entrepreneurial projects.

3. Industrial open innovation: the Future of Work is now

Technological experts, such as those mobilized by Presans Platform, are very likely to be interested in the possibility of participating in projects for equity compensations. Indeed, they tend to already have a personal cash income that makes difficult to use cash as a motivator on a single punctual freelance mission. However, being compensated in equity and have their own interests aligned with those of the company can be a great motivator.

Where does Presans stand on this?

Presans, the leading specialist in industrial open innovation in France, is certainly interested in exploring new modes of compensation for experts, meta-experts, project managers and business developers. The future of work is now.

Bonjour Albert,

merci pour cette idée de motivation du back office.

Pour le front office (la vente), la rémunération à la com a sans doute encore des beaux jours devant elle.

Tru

What if people did not work better for money ?

But for a sense of achievement, a contribution to a purpose aligned with their values, personal development, sharing and developing knowledge, skills and human relationships, building something that will last longer than themselves, etc.

The future of work is NOT in money (not for everybody)