This article raises some thoughts on the transformation of the mobility market both from the point of view of Amazon, the champion of customer experience, and from the perspective of a major energy player with businesses deployed across the entire value chain: Total.

Amazon perfectly embodies the power of digital platforms, as they are able to challenge the hierarchy of any given value chain, regardless of the industry. Total, for its part, shows specific strengths in the race to build dominant platforms… indeed, all starting points are not equal in the race to digital transformation.

1. Are platforms and value chains independent?

The analysis of an economic sector in terms of links in a value chain is based on a framework developed in 1985 by Michael Porter in Competitive Advantage. This framework promotes a linear reading of a sector of activity, in which each actor seeks to improve its position relative to its competitors and close neighbors, in order to increase its margin.

Understanding the disruption in value chains that has been effected by the barbarians of the digital world requires that we develop complementary keys of analysis. As Laure and Benoît Reillier show in their book Platform Strategy, the economic model of the platform is less a new link than a new layer of disintermediation. Since the customer relationship is captured en masse by the platform layer, it can weigh on the margins of the suppliers, regardless of where they are on the value chain of a product.

The question is, therefore: can a platform develop from any link in the value chain? Are platforms and value chains independent, in the sense that a platform could freely connect to a value chain, regardless of the sector of activity? If so, then developing a platform strategy would not need to take into account a company’s position in the value chain.

To answer this question, we will rely on the seven-point numerical analysis method developed by Philippe Letellier, Digital Fellow at Presans. This method invites you to focus initially on three points: customers, bread and butter points, and data.

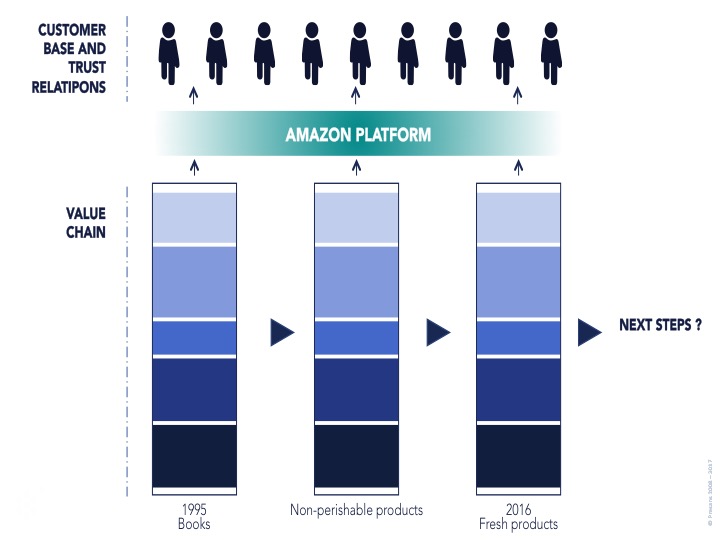

Let’s apply this method for example to Amazon. It is well known that Jeff Bezos’ choice to enter the book market owed nothing to chance: he responded to the bread and butter of the limited choice of books available at a physical point of sale. Subsequently, once its platform was built and it was able to deliver an optimal customer experience, reinforced by the power of data, it became possible for Amazon to consider penetrating all kinds of other value chains (including fresh food).

In a way, the question also arises for non-native companies in the digital world. Although every link in the value chain is considering a platform strategy, there are links with added benefit. The mobility market is no exception to this rule.

Platforms and value chains are therefore not independent at first. They become so, as their success grows. A dominant platform can thus free itself from its origins. Selling books was just a starting point for Amazon, even though this starting point was chosen with discernment.

2. How to become THE mobility platform

The two drivers of mobility

Two specific forces are currently contributing to the transformation of the mobility market:

- Technological innovations, including the electric vehicle, the connected vehicle and the autonomous vehicle.

- Changes in user preferences, from a vehicle ownership model to a usage-based model, the logic of which is developed in our article “To survive, do not sell any more products.”

Relationship and customer experience: keys to a mobility platform

For mobility actors, becoming a platform means being able to offer the consumer a comprehensive mobility offer—an integrated experience. The major stake for the actors of the value chain is thus the expansion beyond the established boundaries of their historical spheres of activity.

A virtuous circle links the user experience and the data: a better customer experience attracts more users, which allows more data to be generated, which in turn can optimize the customer experience. The importance of data should not be overestimated: the starting point is the customer relationship and the user experience.

The control of the consumer relationship and user experience is based on three keys: proximity, frequency and attractiveness.

The proximity of the end user implies the existence of a customer base: a valuable asset, time-consuming and difficult to create from scratch. The size of the client database also influences the volume of data generated by the platform. The closer the platform is to the end user, the larger the customer base and the larger the margins.

Frequency: the higher the frequency of transactions or interactions, the greater the viability of the platform. Transactions that are too far apart in time may discourage the registration of a customer on a digital platform.

The attractiveness of a platform stems from the functions to which it gives access. It is all the stronger because these functions cover the three areas of the necessary, the excellent and the exclusive. It also assumes confidence. Without attractiveness, there are no users, so no data.

3. Who will be the Amazon of mobility?

The mobility market includes a wide range of economic players, including established car manufacturers, car rental companies, public transport companies (SNCF, RATP, etc.), taxis, private carriers (bus companies, etc.), energy experts, bankers and insurers. It also includes, potentially, new players such as GAFAM, Uber or Tesla.

Let’s use the three keys presented above (proximity, frequency, attractiveness) to analyze some of these different types of actors.

Total: best positioned to offer a mobility platform?

- Proximity: Total has a good proximity with a large customer base through its Marketing & Services branch, which manages the network of service stations.

- Frequency: Replacing tires is a less common act than paying for a parking space or for a full tank of gas. Total is the provider with one of the highest frequency of transactions in the mobility market through its service stations.

- Attractiveness: The pre-existing customer base is not enough to attract new customers. The emerging revolution will take the form of mobility-related applications allowing for a S.E.X experience: simple, efficient, and sexy, able to attract new customers and create a new commercial base. In this respect, Total must innovate.

Total’s position therefore benefits from enviable assets. It remains to transform the virtual into real … or the opposite!

Established builders and suppliers: a starting position more difficult than one might think.

- Proximity: the established manufacturers arrive with the disadvantage of not being in direct relation with the final customers of their products (maintenance ensured by an independent network). Building a customer base of sufficient size is a major challenge for them. They suffer from a low proximity.

- Frequency: The transaction frequency is low. However, the builders already practice leasing and can go further in this direction of mobility toward rentals.

- Attractiveness: Manufacturers are fighting to design cars that provide an attractive experience. However, the competition around the attractiveness is fierce.

The position of the manufacturers thus seems less good than that of the renters, who can use their customer base to favorably negotiate fleets of cars with the manufacturers.

Tesla: undeniable assets.

- Proximity: A close proximity relationship with customers to help build a new customer base and massively generate data from all outstanding Tesla vehicles.

- Frequency: A powerful data platform with regular updates of the car’s OS. The high frequency of interactions could be converted into high frequency transactions.

- Attractiveness: Real attractiveness thanks to the design of the product and the services packaged with it.

Tesla is already a mobility platform, but on a small scale. The company’s next challenge is to create a large scale mobility platform.

The new mobility players (Chauffeur Privé, Uber): the strength of the customer experience.

- Proximity: These actors are in close proximity with the end user. The power provided by a powerful customer experience allows them to build a huge customer base.

- Frequency: The frequency of transactions is high.

- Attractiveness: The attractiveness of these new players is already established, thanks to an almost irreproachable user experience.

The new mobility players have a very interesting position in the new mobility space. Their main asset is to propose a scalable and agnostic system in terms of infrastructure.

Today, Tesla is the only player in mobility that concentrates all its assets on creating a mobility platform that complies with the two technological and ecological drivers of mobility—but on a small scale. A giant like Total is in fact well placed to put its strengths of proximity and frequency in the service of the construction of a dominant mobility platform. But we have yet to examine the potential of Amazon.

Amazon: The barbarian is at the gates of the kingdom and can enter at any time.

- Proximity: Amazon’s proximity to the customer is maximum.

- Frequency: Amazon’s transaction frequency is maximum.

- Attractiveness: Amazon attracts by being an undisputed trusted third party, no matter the vertical.

As long as it is accepted that what is important is the customer experience, nothing prevents a company that is foreign to mobility, but queen of the customer experience, to enter the world of mobility. The example of Amazon, a trusted third party for many consumers, is not absurd.

When an actor captures a critical mass of users, they gain a strong position from which to negotiate better prices. The ability to aggregate demand confers a privilege on the rest of the value chain: If Amazon massively entered the mobility market, this could lead to lower margins for some or all other links in the chain. Amazon would, however, release a new margin based on its dominant platform position.

Nothing prevents Amazon from becoming the Amazon of mobility by selling petrol, cars, or both.

Conclusion

Digital transformation leads to strong convergences between different links in value chains and even between different sectors. Everyone feels won over by the desire to encroach on near and less close territories.

When creating a platform, there is no independence between value chains and the success of a platform strategy. Some assets, such as the frequency of interaction and the existence of a customer base, are difficult to create from scratch.

There remains the danger posed by actors of the Amazon type, kings of the customer experience. Their platforms are independent of value chains. They create uncertainty in all sectors of activity: they disturb the tranquility of the links which up to here have been the most sheltered within the value chains.

The only answer to this type of margin-destroying barbarian may well be to become a barbarian yourself — to become the Amazon of mobility.

(*) This article has been produced on the basis of a collaboration with the Total group for several years and an interview with Philippe Montantême, Total Marketing & Services Marketing Research Director, whom we thank for the time that he has granted us.